bir form 2305 purpose|BIR Forms : Pilipinas Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded) 0619-F. Monthly Remittance Form of Final Income Taxes Withheld. 0620. Monthly Remittance .

The Philippine National Police (PNP) has suspended all the online services for gun-related transactions after it confirmed what it described as a possible data breach of the police’s Firearms and Explosives Office (FEO). PNP spokesperson Col. Jean Fajardo said that its Anti-Cybercrime Group (ACG) has already conducted an investigation but .proprietary odds comparison software and odds API and XML feed specialists delivering pre-game and in-running odds from 200+ bookmakers, betting exchanges . Android Only - Active TRADER subscription required. Your mobile gateway to Upcoming Events, Detailed Event odds, and Market Moves. Get in touch. T +44 844 826 5280; E

[email protected] .

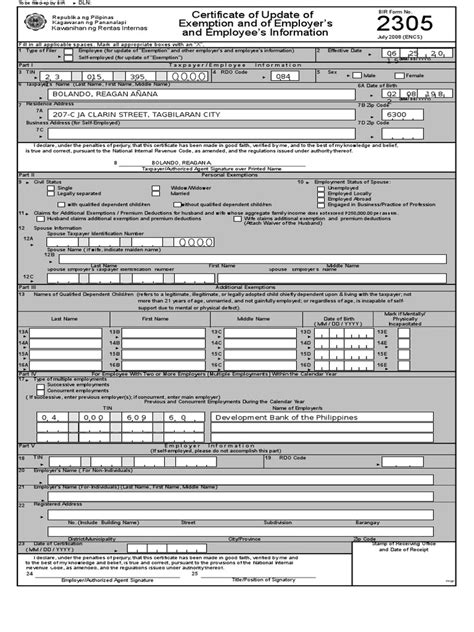

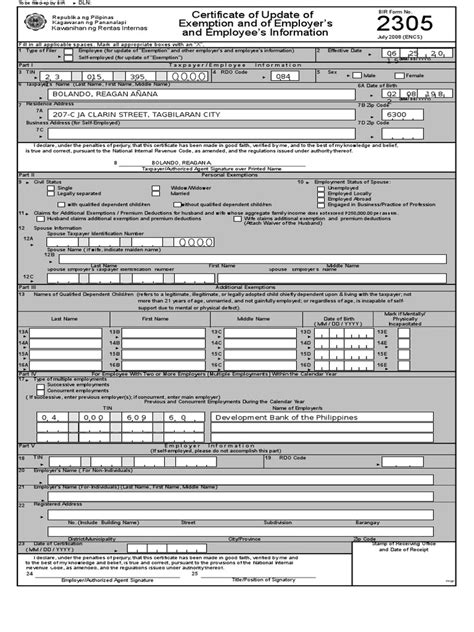

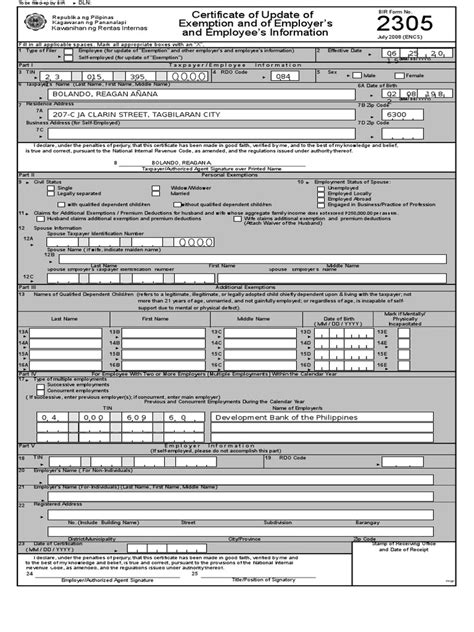

bir form 2305 purpose,BIR Form No. 2305 Certificate of Update of Exemption and of Employer's and Employee's Information. A BIR Certificate to be accomplished and issued in case of increase or decreases in exemption, change of status, change in the person of employer, change in .

20 Jun 2017. IN line with Republic Act (RA) 10754, also known as “An Act Expanding the Benefits and Privileges of Persons with Disability (PWD),” and Revenue Regulations .

To streamline this process, the Bureau of Internal Revenue (BIR) rolled out a new mandate for form 2305, or the Certificate of .bir form 2305 purpose In BIR Form 2305, both the employee’s residential address and the employer’s registered address are provided. However, the RDO having jurisdiction over .

Employers shall be responsible for electronic filing of the tax exemption updates of their employees using BIR Form 2305. With this requirement, no employees should visit the .

Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded) 0619-F. Monthly Remittance Form of Final Income Taxes Withheld. 0620. Monthly Remittance .To be filled-up by BIR DLN: Fill in all applicable spaces. Mark all appropriate boxes with an “X”. . Kawanihan ng Rentas Internas 2305 Certificate of Update of Exemption and of .This document is a Certificate of Update of Exemption and Employer's and Employee's Information form submitted to the Bureau of Internal Revenue (BIR). It contains .We would like to show you a description here but the site won’t allow us.BIR FORM 1905 – Application for Registration Information Update. Documentary Requirements. a) Affidavit of Loss, if applicable; and. b) Proof of payment of Certification .BIR FORM 1905 – Application for Registration Information Update. Documentary Requirements. a) Old Certificate of Registration, for replacement; b) Affidavit of Loss, if lost; and. c) Proof of Payment of Certification Fee and Documentary stamp- to be submitted before the issuance of the New Certificate of Registration.Reports/Forms for Submission by Registered Taxpayers. SAWT (Summary Alphalist of Withholding Tax) - through eSubmission when claiming Creditable Withholding Tax upon filing of: 1701, 1701A, 1701Q, 2550M, 2550Q & 2551Q SLSP (Summary List of Sales and Purchases) - through eSubmission as attachment to 2550Q (RMO No. 4-2003) 0619E .BIR Form No. 2305-page 2 Part IV (for F Change of Civil Status emale Taxpayer only) From Single to Married22 From Married to Single 22A Old Name/Maiden Name (First Name, Middle Name, Last Name) 22B New Name/Married Name (First Name, Middle Name, Last Name) Part V For Employee with Two or More Employers (Multiple .bir form 2305 purpose BIR Forms Page 1 of 1. To be filled-up by BIR DLN: Fill in all applicable spaces. Mark all appropriate boxes with an “X”. 1 Type of Filer Employee (for update of "Exemption" and other employer's and employee's information) 2 Effective Date

We would like to show you a description here but the site won’t allow us. Procedures: 1. Employee submits the BIR Form No. 2305 to employer with required documents; 2. Employer electronically files the return using any of the following formats: Option 1: Microsoft Excel CSV Format; Option 2: Taxpayer’s own extract program; or. Option 3: BIR’s UEE data entry module. Those using option 1 and 2 are required to . BIR Form 2305 for claiming PWDs as dependents. (Revenue Memorandum Circular Nos. 42 and 43- 2017, June 20, 2017) This Tax Alert is issued to inform all concerned on the revised BIR Form 2305 (Certificate of Update of Exemption and of Employers and Employee’s Information). The new version provides for the columns for .

BIR 2305 Form is used to update your Employer Information and Tax Status. By default, the husband is the rightful claimer for additional exemption. If the wife (a 24/7 Customer employee) is claiming for additional exemption, the following must be submitted: o If not legally separated – BIR waiver form (even without the signature of the .BIR Forms BIR Form 2305 (Certificate of Update Exemption and of Employer’s and Employee’s Information) Whenever the employer or employee wants to update or change their information, they have to accomplish this form. This includes change of status, change in the type of employment, or acquiring employment after being registered as engaged in .

Prior to the issuance of RMO No. 37-2019, employees who recently changed employers update their BIR registration records through their new employer by filing a Certificate of Update of Exemption and of Employer’s and Employee’s Information (BIR Form 2305). In BIR Form 2305, both the employee’s residential address and the .Bir Form 2305 is a certificate of update of registration information. This form is used to update the registration information of taxpayers, which .

1. If the employee is registering on his/her own. Inform your new employer that you don’t have a TIN yet. Request the company HR to provide you with two copies of the BIR Form 1902. It should be filled out . I think the 2305 form has been replaced by 1905 na.. no need to submit 2305.. there'a a BIR memorandum about that forms. and sa amin ang employee ang pupunta sa BIR para walang aberya.. hehe 3y Edited

BIR Form No. 2305. BIR Form No. 2305 shall be filed electronically by the employer using any of the following format: Option 1 – Microsoft Excel CSV format; Option 2- Taxpayer’s own extract program; or. Option 3 – BIR’s UEE Data Entry Module. Use of Option 1 and 2 requires validation using the 2305 Batch File Validation Module.

Employers shall be responsible for electronic filing of the tax exemption updates of their employees using BIR Form 2305. With this requirement, no employees should visit the RDOs to file the update form. The Form is used for the following: 1. Updating of employee’s additional exemption for dependents. 2. Change of status. These BIR forms have a specific use and purpose, so make sure that you are submitting the correct forms. 1900. Application for loose leaf/books of accounts. This should be accomplished by all .Republic of the Philippines Department of Finance Bureau of Internal Revenue. Certificate of Update of Exemption. and of Employer and Employee’s. Information. BIR Form No. 2305. April 2017 (ENCS) Fill in all applicable white spaces. Mark all appropriate boxes with an .BIR Form No. 2305-page 2 Part IV (for F Change of Civil Status emale Taxpayer only) From Single to Married22 From Married to Single 22A Old Name/Maiden Name (First Name, Middle Name, Last Name) 22B New Name/Married Name (First Name, Middle Name, Last Name) Part V For Employee with Two or More Employers (Multiple .

bir form 2305 purpose|BIR Forms

PH0 · What’s new in BIR registration for employees

PH1 · To be filled

PH2 · New versions of BIR Form 2305 and Update of Exemption of

PH3 · Mandatory eFiling by employers of employee personal exemption updat

PH4 · Mandatory eFiling by employers of employee personal exemption

PH5 · BIR Home

PH6 · BIR Forms 1905 and 2305 – JustPayroll

PH7 · BIR Forms

PH8 · BIR Form No. 2305 Certificate of Update of Exemption and of

PH9 · BIR Form 2305 Certificate of Update

PH10 · BIR FORM NO. 2305 Certificate of Update of Exemption and

PH11 · Application for Registration Update